Insurance With No Car - No Problem!

The non-owner policy is intended for individuals who do not own or have regular access to a vehicle. If your license has been suspended, it can be a good (cheap) way to satisfy the state financial responsibility requirements.

Insurance for a car that someone else owns is different.

You might want to insure a car that you don’t own. At first glance, the non-owner policy may seem obvious but that would not be correct. If this is your situation; Do NOT buy a non-owner policy. A regular auto insurance policy would be a better fit. Just make sure to tell your agent who owns the vehicle before buying the policy.

What Type Of Policy Should You Get?

Non-owner Insurance = you don’t have a car and aren’t trying to cover a car that someone else owns. Quote Non-owner

Auto Insurance = you have a car (or someone else’s car) that you want coverage on. Quote Auto

What Does The Non-Owner Policy Cover?

The non-owner policy provides very minimal coverage that only applies in very special situations. Most people that buy this type of insurance are doing so to satisfy a court or state requirement. Usually, an SR22 or similar filing will be attached to the policy.

If you plan to use a non-owner or named driver policy as a way to provide coverage in case something were to happen, make sure to discuss your needs with a knowledgeable agent.

Common Questions About Non-owner Insurance

We have seen it as low as $19/month. But just like other insurance, your pricing will vary based on age, violations, prior coverage, etc.

The nonowner is usually cheaper than insuring a vehicle but it also provides less coverage.

We have seen some rental agencies allow this.

Keep in mind that the nonowner policy will provide liability coverage for vehicles that you don’t own or have regular access to. If you are renting for an extended period, a different policy may be better for you.

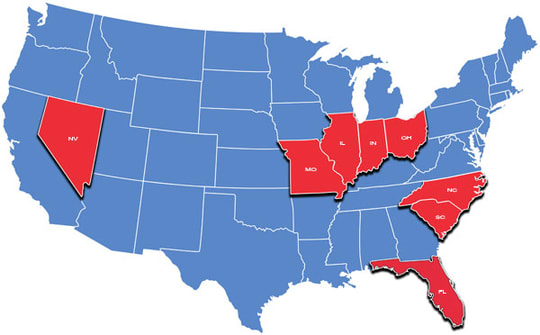

The nonowner policy will not necessarily make you legal to drive. Most states (like Missouri) require proof of insurance on the actual vehicle.

The nonowner policy will not cover you when driving any vehicle owned by you, your spouse, a household member, or while using any vehicle that you may have regular access to.

Yes.

The nonowner policy is known by many different names like; non-driver, non-car owner, named driver, etc.

It most cases, normal discounts like prior coverage, married, homeowner, etc. can be applied to a nonowner policy.

Yes but you will need a different policy for the vehicle(s)

Sometimes people will buy the non-owner in order to get get a cheap sr22. Let us know what you are doing so that we can set you up the right way.

Discount Insurance Group Is Experienced With The Non-Owner Policy

Getting a great price is awesome but getting the right product is very important. Feel free to talk things over with one of our knowledgeable sales agents before you purchase a non-owner policy.

*Rules and details will vary by state.

Please call us if you have any questions.

Related Products: sr22 insurance, high risk insurance